|

|

Walter Menteth, Owen O’Carroll, Russell Curtis and Bridget Sawyers. Public Construction Procurement Trends 2009–2014. — 2014  Public Construction Procurement Trends 2009–2014 / Walter Menteth, Owen O’Carroll, Russell Curtis and Bridget Sawyers ; Project Compass CIC. — Published by Project Compass CIC, 2014. — 63 p., ill. — ISBN 978-0-9931481-0-1Foreword

This report evaluates UK public sector architectural design procurement for commissions that come within the remit of the European Union Directive 2004/14 and its threshold values.

All applicable services and works notices published within the Official Journal of the European Union (OJEU) between Q4 2008 to Q3 2014 have been captured where the data contains the relevant Common Procurement Vocabulary (CPV) codes and or references that a relevant architectural design service has to be provided within descriptions of a projects requirements.

Project Compass has captured around 11,001 OJEU notices, generating entities to cover all notice types in all procedures and under all instruments with frameworks, lots and their contents.

52 data fields analyse, recorded and categorized descriptions, numbers, quanta, criteria, requirements, conditions, thresholds, constraints, objectives, dates and values. It has generated a detailed correlated analysis of differing notice types, procedures, lots and awards. Finally the analysis has been curated in order to correct spelling mistakes, errors and variations in naming conventions and to review, resolve and edit entities were there have been obviously erroneous entries in the originating data. The data has however excluded entities in exceptional circumstances where data entries have been irreconcilable.

The methodologies otherwise are detailed in Section 13 'About the data' of this report.

The UK construction industry has an annual turnover of more than £100bn representing almost 10% of UK GDP, with some 40% of this being spent in the public sector. The majority of these projects directly and to a greater extent indirectly employ architects.

Project Compass CIC intend this to be the first of their publications on UK trends which report on the current market, its progression, impact and in due course the outcomes of reform.

This will contribute towards improving knowledge among commissioners, construction professionals and industry that can inform the important and necessary changes to procurement culture and its application in practice that will also be required to accompany the legal reforms.

The legal framework

The primary legislation covering UK competition practice for architects in the public sector is determined at European level. The most relevant being the Public Directive 2004/14/EC (The Classical Directive), although the Utilities Directive 2004/17/EC also has occasional relevance. The Remedies Directive 2007/66/EC concerning the award of contracts and their review procedures also applies.

“The original aim of the European Union Directive was to create a larger and more open market with a reasonably level playing field in which small, medium and large practices could compete fairly.

It is clear that there has been an increasing bias placed within the OJEU notices which has distorted equality of opportunity, which combined with an increasing lack of transparency is undermining confidence in them and making the procedure to participate ever more expensive. The result is unsustainable for the architectural profession. This report is most timely and welcome, and hopefully politicians and those who should be supporting the industry and the professionals working within it will take notice and act appropriately."

Ian Ritchie CBE, Director Ian Ritchie Architects

In compliance with EU Treaty obligations these endeavor to legally enshrine the principles of transparency, equal treatment and non-discrimination.

The EU legislation is then transposed and adopted into UK law. For example in England, Wales and Northern Ireland the Classical Directive is transposed through 'The Public Contract Regulations 2006' and in Scotland 'The Public Contract (Scotland) Regulations 2012'. The other Directives and Remedies Directive have also been transposed.

For central Government contracts The Regulations are supplemented by government guidance notes known as Procurement Policy Notes (PPN's).

For local authorities and others this guidance on implementation is most frequently imposed through their orders or regulations.

Gold Plating

This law is complex, lacking in transparency, difficult to comprehend and has been the cause of much criticism.

In the UK in particular confusion in interpretation and risk averse practices have frequently lead to inappropriate, disproportionate, discriminatory application and gold plating of requirements that has had significant economic consequences with impacts on costs, access, growth, employment and sustainability. Equally the architectural profession has not been conversant with this complexity to their own detriment and has served to marginalise Architect's power to influence betterment.

2014–2015 may be remembered as a landmark years for procurement.

New legislation EU Public Procurement Directive 2014/24/EU reforming the previous directive was adopted in Febuary 2014. Through repeal of the previous regulations this will be transposed into the UK Public Contracts Regulations 2015, which are anticipated to be placed before Parliament in spring 2015.

Future implementation of eProcurement as specified within Directive 2014/24/EU, adoption of The Public Contract Regulations 2015, and the provision of Contracts Finder, the proposed UK national procurement portal might, it is to be hoped, contribute towards significant improvements in transparency, access, proportionality and practice, as well as many of the other important issues highlighted by this report.

ii Headlines

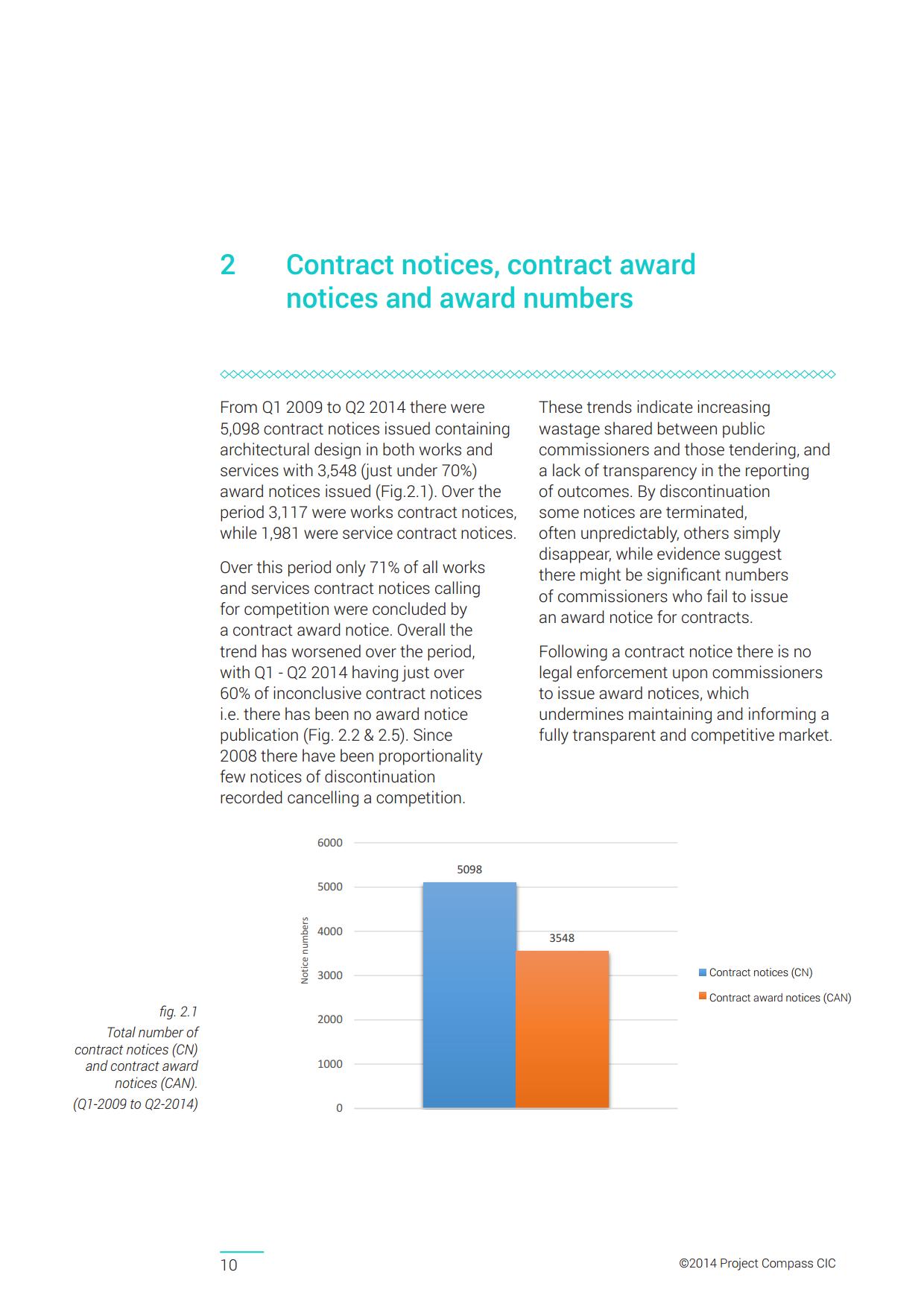

Over 30% of all the contract notices captured have not been concluded by an award notice. This trend is getting worse and represents significant waste for all.

Around 10% of all award notices declare no range or contract values.

There are clear issues with market transparency.

Service contract notices and service awards are in decline. These represent the major opportunities for individual awards to project specific briefs.

The large majority of architectural contract notices and awards however are to be found in contracts requiring multi-disciplinary teams (architecture+).

Proportionately more work is now typically to be found in lots, with the greatest numbers of opportunities per notice to be found in architecture+.

27% of service contract appointments have been onto frameworks and this trend is increasing.

The time taken by procedures had by 2013 accelerated to 221 days. This compares to the EU average of 133 days.

Out of the 6 procedures currently available for the appointment of an architect 81% of contract notices are restricted procedures.

There have been only 2 open design contests in the UK since 2008.

48% of opportunities are now in 'hidden architecture' where the facilitator, developer or contractor is asked to provide the design services, with architects as tier 2 sub- contractors. This has reduced open competition, access and choice for the public.

The North East region made only 58 awards in the period, with none in 2010.

For 2011 2 hub contract notices in Scotland with 1 lot each and values totalling £1.4bn significantly skew UK results.

In works and service contracts 4,000 firms had won between 1 and 10 awards and made up 94.5% of all winning firms. However this only amounted to 56.8% of all the awards. The remaining 5.5% of firms won 43.4% of all awards.

For the direct appointment of architects the numbers and values of opportunities are in decline whilst those on offer are being increasingly aggregated.

<...>

Contents

1 Summary trends in architectural contracts ... 6

2 Contract notices, contract award notices and award numbers ... 10

3 Contract notice procedures - 2013 ... 16

4 How many lots and architectural opportunities? ... 20

5 What are the procedures? ... 24

6 Who are the clients? ... 28

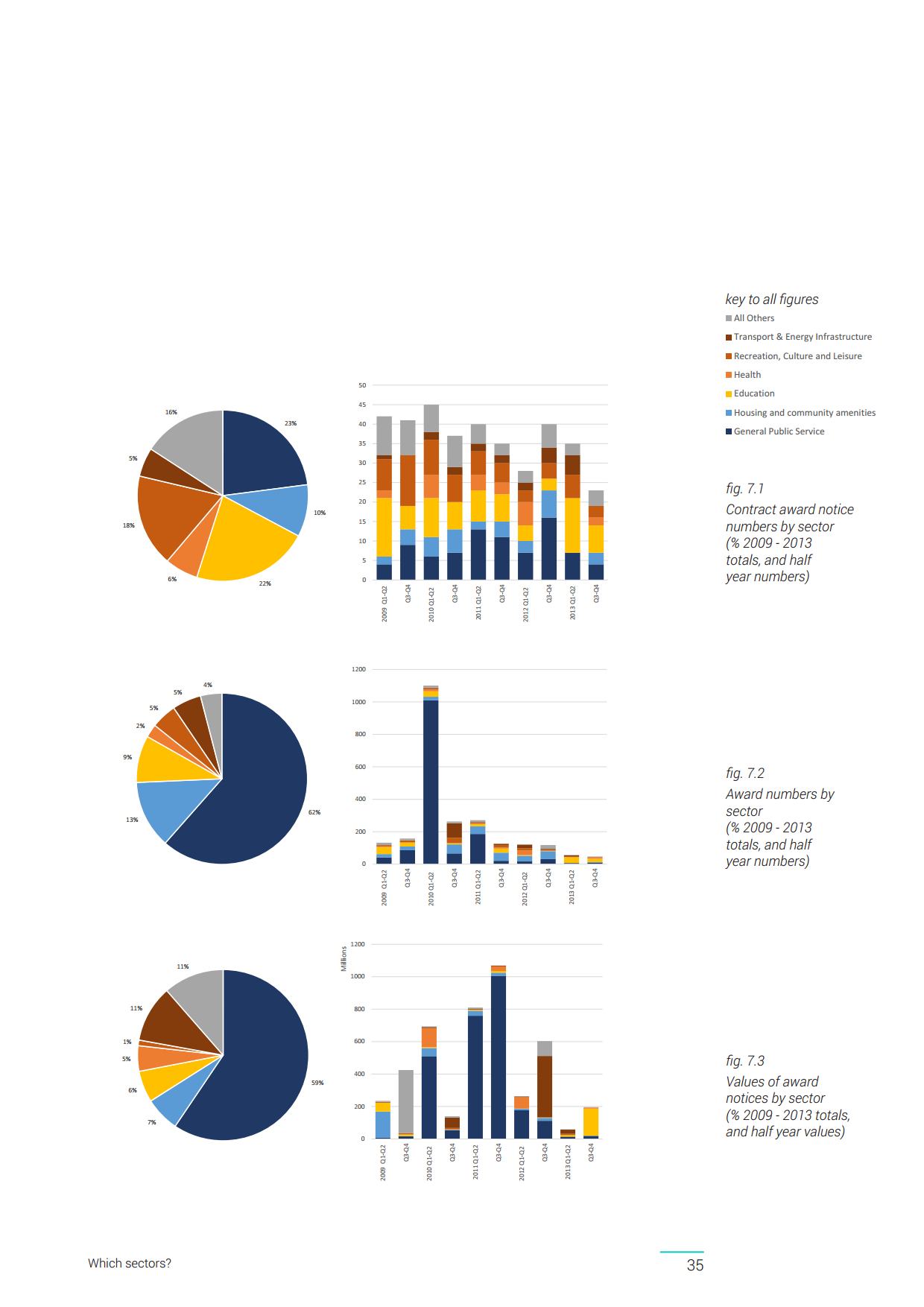

7 Which sectors? ... 34

8 Frameworks ... 38

9 Regional distributions ... 40

10 How long are procedures taking? ... 48

11 Which contractors are winning? ... 52

12 Which architects are winning? ... 56

13 About the data ... 60

14 About Project Compass CIC ... 62

15 Project Compass CIC directors ... 63

Sample pages

Direct download link (pdf; 5,4 MB).

17 октября 2022, 22:46

0 комментариев

|

Партнёры

|

Комментарии

Добавить комментарий